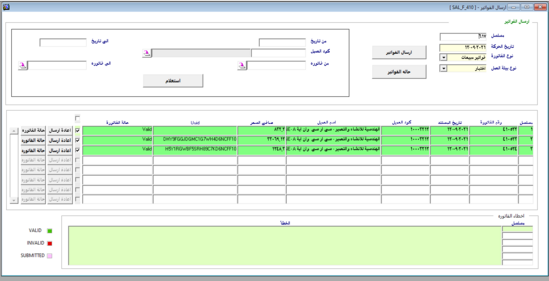

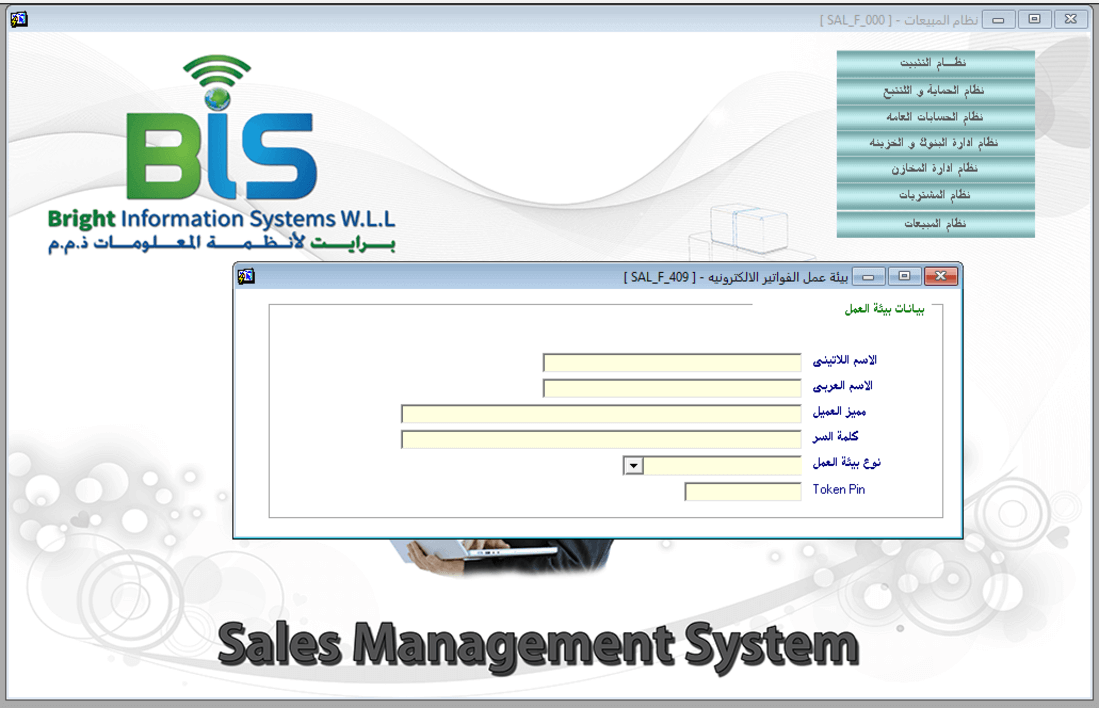

E-invoice integration in Egypt

Electronic Billing System in Cairo

It is a procedure aimed at converting the process of issuing paper bills and notices to an electronic one. This system allows the exchange of debit and credit invoices and their electronic processing in an organized manner between the seller and the buyer to complete the work faster and more efficiently.

What is an Electronic Invoice?

A tax invoice that proves transactions of buying and selling goods and services is issued and saved in an electronic format based on an electronic signature through unified codes for those products and not by copying or scanning the paper invoice. The electronic invoice depends on the electronic signature, in which validity and effectiveness are required, and the standard codes for goods and services, which help in the statistics and analysis of different sectors and contribute significantly to supporting decision-making. It is a system for using information technology to convert invoices into electronic copies that are recognized in all governmental and international transactions. It includes all commercial transactions:

Advantages of Electronic Invoice